Oregon probate costs vary based on estate value, complexity, attorney time, and services rendered, including document preparation, asset identification, tax guidance, and conflict resolution. Legal professionals charge hourly rates or flat fees, offering transparency and predictability. Effective management involves staying informed, clear communication, organized record-keeping, and appointing a competent executor to reduce legal expenses.

Understanding Oregon probate attorney fees can be a complex task for laypersons, but it’s crucial for managing estate affairs. This article demystifies probate costs in Oregon, breaking down key components and services covered. We explore factors influencing these costs, including case complexity and attorney experience. Furthermore, we compare traditional hourly rates to flat fees, offering insights into cost-effective strategies. By grasping these concepts, folks can navigate Oregon’s probate process with greater clarity and control over associated expenses.

- Understanding Oregon Probate Attorney Fees

- Types of Legal Services Included in Fees

- Factors Affecting Probate Costs in Oregon

- Hourly Rates vs. Flat Fees Explained

- How to Keep Oregon Probate Costs Manageable

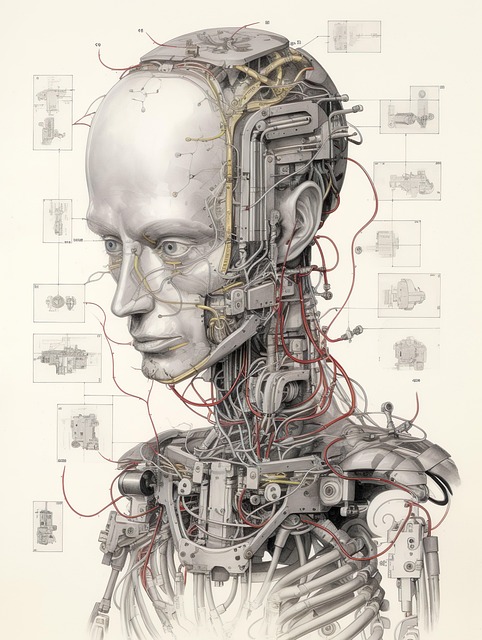

Understanding Oregon Probate Attorney Fees

Understanding Oregon Probate Attorney Fees

In Oregon, probate attorney fees are a crucial aspect to consider when navigating the complex process of estate administration. These fees are charged by legal professionals who assist with various tasks, such as filing necessary documents, managing property distribution, and ensuring compliance with state laws. The cost can vary depending on several factors, including the value of the estate, the complexity of the case, and the time required by the attorney to complete the work.

Oregon probate costs are typically structured using hourly rates or a contingency fee arrangement. Hourly rates mean you’ll be charged based on the number of hours worked, while contingency fees are a percentage of the final settlement or inheritance. It’s essential to discuss these fee structures openly with your attorney to understand how they will bill for their services and ensure transparency throughout the probate process.

Types of Legal Services Included in Fees

When discussing Oregon probate attorney fees, it’s crucial to understand the range of legal services included in these costs. Often, probate attorneys provide a comprehensive set of services that extend beyond mere document preparation and court appearances. This may include advising clients on estate planning strategies, drafting or reviewing wills and trusts, and guiding them through the complex process of administering an estate.

Additionally, fees can cover various tasks such as identifying and valuing assets, dealing with tax issues related to the probate process, and managing conflicts among heirs or beneficiaries. Some attorneys may also offer assistance with trust administration, ensuring that the wishes of the deceased are carried out accurately and in compliance with legal requirements. These services collectively contribute to the overall Oregon probate costs, reflecting the professional expertise and time invested in navigating what can be a delicate and challenging legal landscape.

Factors Affecting Probate Costs in Oregon

Probate costs in Oregon can vary significantly based on several factors. The complexity and size of an estate are primary considerations; larger, more intricate estates with numerous assets and beneficiaries typically incur higher fees. The location where the probate is handled also plays a role; urban areas like Portland tend to have higher legal costs than rural regions.

Additional influences include the type of property in the estate, such as real estate or valuable personal belongings, which might necessitate specialized services. The involvement of a lawyer specializing in probate, their experience level, and the time they invest in the case are also reflected in the fees. Finally, court fees and taxes associated with the probate process add to the overall Oregon probate costs.

Hourly Rates vs. Flat Fees Explained

Many people wonder about the cost of hiring an Oregon probate attorney, especially since probate can be a complex and time-consuming process. When it comes to legal fees, there are two primary models: hourly rates and flat fees. Hourly rates mean the attorney charges a predetermined price for each hour worked on your case. This model is common in many legal settings as it provides clients with a clear understanding of potential costs. However, probate cases can vary widely in duration and complexity, leading to unpredictable bills.

On the other hand, flat fees offer a set price for the entire probate process, regardless of the time spent. This approach is more straightforward and predictable for clients, as you’ll know exactly what you’re paying for from the start. Flat fees are often preferred for probate cases because they eliminate unexpected charges and provide peace of mind throughout the legal journey. When considering Oregon probate costs, discussing fee structures with a qualified attorney is essential to understanding your financial obligations.

How to Keep Oregon Probate Costs Manageable

Keeping Oregon probate costs manageable is a priority for many individuals navigating the process. One effective strategy is to stay informed about potential fees and seek clarification from your attorney early on. Oregon probate attorneys are required to provide a detailed breakdown of their charges, making it easier to understand and budget for expenses. Regular communication with your legal counsel ensures you’re aware of any additional costs that may arise during the administration of the estate.

Additionally, consider the complexity of your case when estimating Oregon probate costs. Simplifying the process through organized record-keeping and clear instructions can help reduce attorney fees. Appointing a reliable executor or personal representative can also streamline matters, minimizing legal involvement and, consequently, lowering overall expenses.