Probate attorney fees in Oregon vary based on estate size, complexity, and duration, with potential costs capped at 5% of the estate value. These fees cover legal services from initial consultations to document drafting, court appearances, and asset distribution. Additional expenses include court filing fees, appraisals, and administrative costs. Planning is essential for budgeting, especially in complex cases or with multiple beneficiaries. Flexible payment plans and pro bono services are available for cost-effective representation.

“Navigating the complex landscape of Oregon probate law can be a daunting task for families, especially when considering the associated legal costs. Understanding Oregon probate attorney fees is crucial for making informed financial decisions during an emotionally challenging time. This article provides insights into the factors influencing legal expenses, services covered by these fees, and common probate-related expenditures. By understanding these aspects, families can better budget and seek affordable options, ensuring they receive competent legal support tailored to their unique needs.”

- Understanding Oregon Probate Attorney Fees

- Factors Affecting Legal Costs in Oregon

- Types of Services Included in Fees

- Common Expenses During the Probate Process

- Budgeting for Oregon Probate Legal Services

- Seeking Affordable Oregon Probate Attorneys

Understanding Oregon Probate Attorney Fees

Understanding Oregon Probate Attorney Fees

In Oregon, probate attorney fees are a crucial consideration for families navigating the complexities of estate administration. These fees are designed to compensate legal professionals for their time, expertise, and resources dedicated to ensuring that a deceased individual’s assets are distributed according to their wishes. The amount can vary significantly based on several factors, including the size and complexity of the estate, the number of beneficiaries, and whether there are any disputes or contests during the probate process.

Oregon probate laws outline reasonable fee structures, often capped at a percentage of the total value of the estate. This approach ensures transparency and fairness, allowing families to budget effectively. Legal professionals may charge either a fixed fee for specific services or an hourly rate, with the latter being more common in complex cases. Understanding these fee arrangements is essential for families looking to manage their financial expectations during what can be a challenging time.

Factors Affecting Legal Costs in Oregon

Several factors influence probate attorney fees in Oregon, making it essential for families to understand these variables before engaging legal services. One key factor is the complexity of the estate and the specific tasks involved in administering it. Simple estates with minimal assets and clear beneficiaries typically incur lower fees, while complex cases with multiple parties, valuable properties, or disputes often require more extensive legal work and expert knowledge, driving up costs accordingly.

Another significant determinant is the time invested by the attorney. Probate proceedings can vary greatly in duration, from relatively swift settlements to lengthy battles over will validity or asset distribution. The longer the process, the higher the potential legal expense. Additionally, attorneys’ rates vary across Oregon, with urban areas like Portland generally commanding higher fees compared to smaller towns and rural regions due to the cost of living and competition among lawyers.

Types of Services Included in Fees

When considering probate attorney fees in Oregon, it’s essential to understand what services are typically included in these costs. A comprehensive set of services often encompasses a range of tasks that facilitate the efficient administration of an estate. This includes initial consultations and case evaluations, where attorneys assess the unique circumstances of each case. They draft and file necessary legal documents, such as wills, trusts, and petition for probate, ensuring compliance with Oregon’s stringent regulations.

Further, these fees cover court appearances, whether it be for hearings, meetings, or representations at various stages of the probate process. Estate administration, including identifying and valuing assets, managing debts, and distributing property according to the testator’s wishes, is another core service. Additionally, many Oregon probate attorneys offer assistance with tax planning, estate tax return preparation, and potential appeals, ensuring that every aspect of the probate process is handled expertly and in accordance with local laws.

Common Expenses During the Probate Process

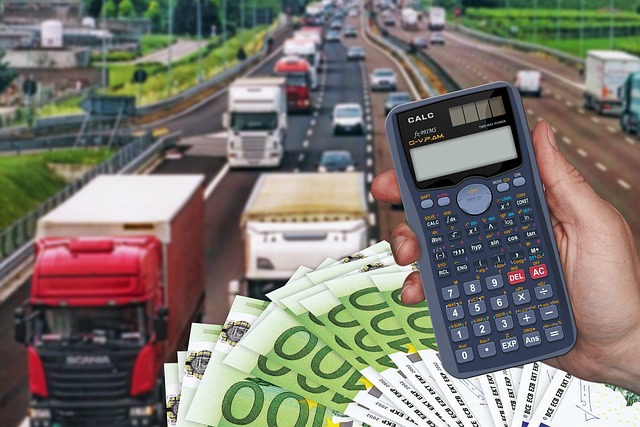

The probate process in Oregon involves several legal procedures and documentation, which can lead to various expenses for families going through it. One of the primary considerations is the probate attorney fees Oregon. These fees vary depending on the complexity of the estate, the value of assets, and the time required to settle the affairs. Common expenses include court filing fees, appraisals for real estate and valuable possessions, and legal research costs.

Additionally, families may incur expenses related to public notices, administration of the estate, and potential disputes among beneficiaries. Some legal tasks, such as preparing wills and trusts, drafting petition documents, and representing clients in court, contribute significantly to probate attorney fees Oregon. Understanding these potential costs is essential for families planning their estates or currently navigating the probate process.

Budgeting for Oregon Probate Legal Services

Budgeting for Oregon Probate Legal Services can be a challenging task, as probate proceedings often involve complex legal issues and variable fee structures. It’s important to understand that probate attorney fees in Oregon are typically based on a percentage of the total estate value, with rates varying between 1-5% depending on the lawyer’s experience and the complexity of the case. This means that even small estates can accumulate significant legal expenses.

Families should be prepared for potential costs beyond the standard probate attorney fees. Additional expenses may include court filing fees, professional appraisals, and various administrative costs associated with estate administration. When budgeting, consider the overall financial impact, especially if there are multiple beneficiaries or disputes among family members. Early consultation with a qualified Oregon probate attorney can provide valuable insights into expected fees and help families make informed decisions about their financial planning.

Seeking Affordable Oregon Probate Attorneys

When facing the complex process of probate in Oregon, many families find themselves wondering how they will afford a competent legal representative. Probate attorney fees in Oregon can vary widely depending on several factors, including the value of the estate, the complexity of the case, and the level of service provided. However, it’s essential to remember that accessing quality legal advice is crucial for ensuring the process goes smoothly and your loved one’s wishes are respected.

Fortunately, there are ways to find affordable Oregon probate attorneys without compromising on expertise. Many law firms offer flexible payment plans or contingent fees, allowing clients to spread out payments or only pay if a successful outcome is achieved. Additionally, some organizations provide pro bono services for those who qualify, offering legal assistance at little to no cost. Researching and comparing attorney profiles can help families identify professionals who meet their budgetary needs while still delivering the high-quality representation required in probate matters.